With 2012 behind us, it is time to look at what major trends will be shaping the asset and wealth management industry in the coming year.

With 2012 behind us, it is time to look at what major trends will be shaping the asset and wealth management industry in the coming year.

The Changing Landscape of Fiduciary Risk

Fiduciary awareness is more crucial than ever as the debate over a uniform fiduciary standard on all investment professionals continues to rage in Washington and on Wall Street. With the SEC committed to proposing a fiduciary standard this year, and the Department of Labor also anticipated to release its own new fiduciary rules in 2013, how firms handle the changing regulations landscape will be make or break factor in their success.

In an interview with PlanSponsor on mitigating fiduciary risk, Doug Fisher, Senior Vice President at Fidelity Investment, said:

“In the last Congress, we saw several legislative initiatives that dealt with fiduciary issues. This Department of Labor is really taking a bottom-up view of the Employee Retirement Income Security Act. In my 20 years on and off Capitol Hill, I really haven’t seen such an activist Department of Labor regarding fiduciary issues.”

Fisher stated that the major fiduciary issues include:

- Disclosure regulations

- Qualified default investments

- New target-date fund disclosures

- Employer checklist regulations

- New benefit statement regulations

- Fiduciary advice regulations

Continued Pressures on Profitability

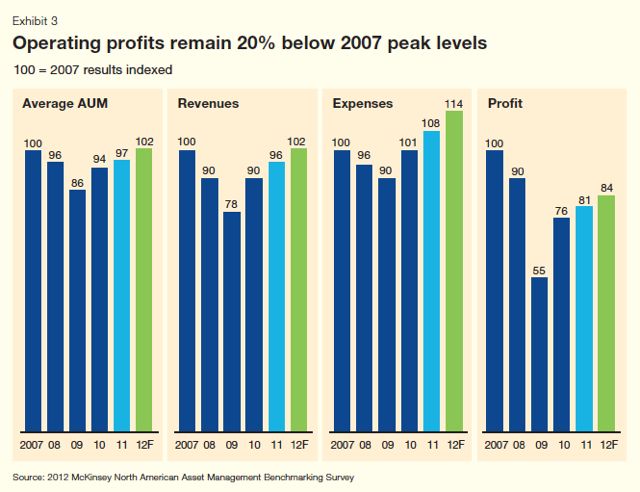

Though profit margins are up, profits as a precent of assets under management are still far from 2007 highs. McKinsey’s 2012 Asset Management Survey states that profit pressure is due to:

Though profit margins are up, profits as a precent of assets under management are still far from 2007 highs. McKinsey’s 2012 Asset Management Survey states that profit pressure is due to:

“Escalating costs, reduced productivity and lower pricing. Even when assets peaked in early 2011, overall profit levels remained badly depressed relative to 2007. Core asset classes/vehicles in particular are under pressure, with lower priced passive investments taking market share from actively managed funds.”

With costs rising in management, marketing, technology, and operations, many wealth managers are finding it extremely difficult to increase their profit margins.

Mainstreaming of Alternative Investing

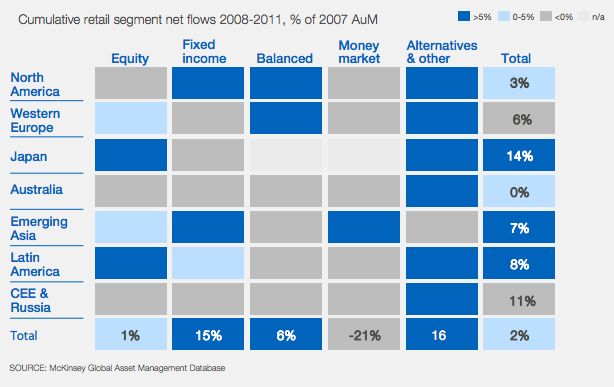

Alternative investments across retail and institutional segments has doubled in size between 2005 and 2011, to $8 trillion in global assets under management. According to McKinsey, 2013 will show continued growth as alternatives go mainstream.

In the McKinsey Survey, they write:

“This shift [towards alternatives] is being spurred by three trends: the adoption of alternatives by retail investors, the convergence of asset classes and investment products, and a broader movement from relative return to absolute return benchmarks. It remains to be seen how much increasing regulatory pressure will counterbalance these favorable trends.”

Alternative Investments are comprised of:

- Hedge funds

- Private equity funds

- Real estate

- Infrastructure

- Commodities

- And a variety of vehicles including limited partnerships, fund of funds partnerships, and managed accounts in mutual funds, ETFs and UCITs

In 2013, wealth managers will face ramped up regulations from Washington, a client base still focused on risk aversion and transparency, continual pressures on profitability, and industry flows moving towards alternative products. However, with all this economic uncertainty and shifts within the industry, this is when great asset managers will really shine. David White, a contributor to Seeking Alpha, even went so far as to declare 2013 the year of the asset manager. Let’s hope he’s right.