2012 was a brutal year for most hedge funds, but a recent report highlights one sector that was performing well above average: hedge funds owned or managed by women.

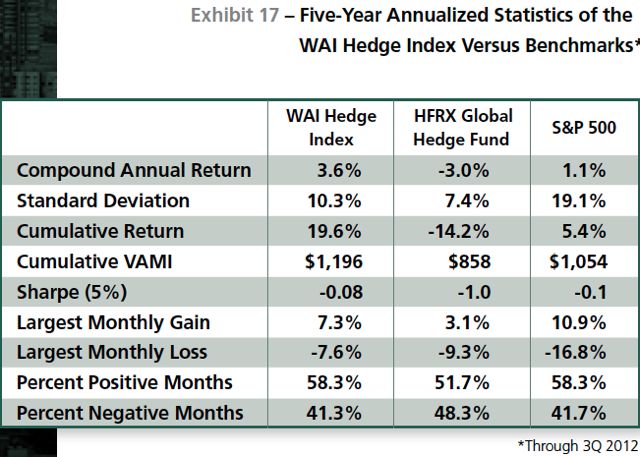

These results from the second annual survey of Women in Alternative Investments by professional services firm Rothstein Kass had the financial services industry buzzing. According to the study, female hedge fund managers (referred to as the Women in Alternative Investments (WAI) Hedge Index) produced a return of 8.95% while the HFRX Global Hedge Fund Index, released by Hedge Fund Research, had a 2.69% net return.

Hedge Funds Run by Women Beat the Industry

For Meredith Jones, director at Rothstein Kass, these numbers aren’t surprising:

“There have been a number of studies that show women investors to be more risk averse, and therefore potentially better able to escape market downturns and volatility. These numbers certainly make that case yet again.

“But perhaps more importantly, the outperformance by women-owned or -managed hedge funds should make the case that investing in these types of funds is a smart business decision, rather than one that just feels good. In an age where every drop of alpha is critical to an investor’s portfolio, performance has to be a driving force in any investment, and women-owned and -managed funds appear to generate that in spades.”

A Dearth of Women-Run Alternative Funds

Even though women-owned or -operated alternative funds are performing better than the industry’s average, only 16% of alternative investment firms are owned or run by women.

The report states:

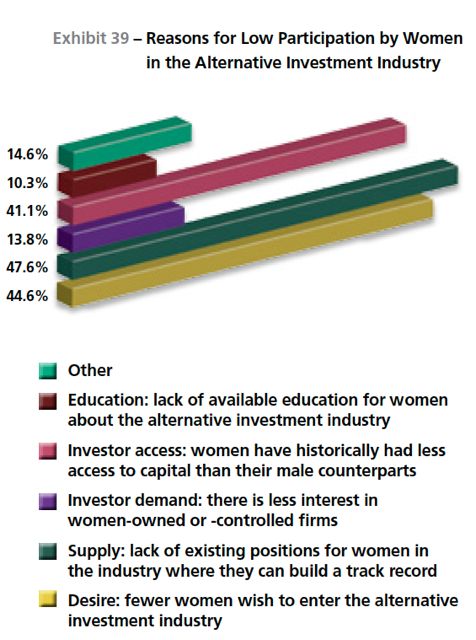

“Respondents cited two primary reasons for the shortage of women in the alternative investment industry: a lack of available positions in the industry where a woman can develop a track record and a lack of motivation among women to enter or stay in the industry.”

Until women are given access to the stretch assignments that prepare them for running their own fund, there will be a lack of women managed funds. But, more than anything, women working within the industry feel that “the investment management in general, and the alternative investment industry specifically, remains one of the last bastions of the ‘old boys’ club.'”

Nearly two-thirds of the survey respondents stated that being a woman made it more difficult to succeed in the alternative investment industry.

Kelly Easterling, principal-in-charge of Rothstein Kass’ Walnut Creek, CA office, writes:

“There is definitely a shortage of women-owned or -managed funds at present, and any significant upsurge in investor demand for these funds could quickly hit capacity constraints. However, this type of pent-up demand could actually create a virtuous cycle for the development of women CIOs and women portfolio managers, with the promise of future assets driving hiring trends, as well as tempting more women to stay within the industry. One of the top factors for women struggling within the alternative investment industry is access to capital. Increasing investor demand could remove at least this obstacle for women going forward.”

Increasing Investor Demand

The report states that 2012 showed an increased number of women- and minority-owned requests for proposals issued by institutional investors.

Investors, looking to better mirror their constituent base, are interested in placing money funds run by women. The report lists numerous public pension plans with RFPs for women-owned funds. Including:

- The Laborers’ & Retirement Board Employees’ Annuity & Benefit Fund of Chicago issued a $20 million RFP for a woman-owned fund of hedge funds.

- The Maryland State Retirement and Pension System awarded a $44 million allocation to a woman-owned, single-manager hedge fund.

- The Connecticut Horizon Fund issued a $100 million RFP for a diversity fund of hedge funds

- The New York City Retirement Systems voted to increase allocations to diversity-qualified asset management firms by$500 million.

Deborah Farrington, general partner, StarVest Partners, LP, states:

“With capital raising a continuing challenge for the alternative investment universe, we expect that emerging manager mandates could have a large impact on funding and supporting women-owned funds in the next 12 to 18 months, which will be critical to maintaining and increasing the participation of women in these vital investment sectors.”

Hurdles to Overcome

Despite women-run hedge funds outperforming the industry and a growing appetite among institutional investors for women-run funds, there are still numerous obstacles.

Camille Asaro, principal at Rothstein Kass, states:

“Many of the mandates in the past have required a minimum size of AUM in order for a firm or fund to participate in the search. Because women-owned and -managed firms tend to be smaller, this could be an obstacle for funds going forward. Other mandates have required SEC registration or women-owned certification status from a state or national entity, which creates more, not fewer, hoops to jump through. It would be foolish to think that institutions are willing to reduce their basic investment standards solely in an effort to include one demographic group in their portfolios, and as a result, women-owned or -managed firms will continue to have to up their game to participate.”

Regardless of these hurdles, there is a good deal of positive news in the Rothstein Kass survey. Putting more women in positions of power in the financial services industry is not just good for women, it is good for investors, the industry, and, most importantly, the bottom line.

Renee Haugerud, founder and chief investment officer of Galtere Investments, states, “Diversifying assets by gender is as important, and possibly more important, than asset class and geographical diversification. If your investment team isn’t diverse, then your portfolio isn’t either.”