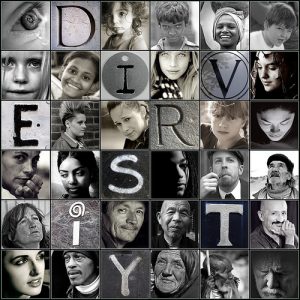

Turn on the news in any given week and you’re bound to hear one report or another about the changing socio-economic face of American society. Changes range from shifts in workplace gender equity to the racial makeup of the population. Among the recent headlines:

Turn on the news in any given week and you’re bound to hear one report or another about the changing socio-economic face of American society. Changes range from shifts in workplace gender equity to the racial makeup of the population. Among the recent headlines:

- 10 states thus far have legalized same-sex marriage and another 12 are expected to follow in 2013-14;

- According to a recent report from the Pew Research Center, women are now the sole or primary source of family income in 40% of U.S. households with children;

- The U.S. Census Bureau predicts that by 2043, the U.S. will have a ‘minority-majority’ of non-Hispanic, white Americans.

What, you may ask, does this have to do with asset management? In a nutshell, a lot. According to a recent survey of advisors presented by Pershing at its Insite 2013 conference, many advisors do not have an accurate perception of their client base and thus are missing opportunities to secure affluent new clients. Furthermore, Pershing asserts, women advisors are particularly well-situated to capitalize on these emerging markets as they have already been focusing on under-served constituencies for some time.

The Issues

Among the issues revealed by the survey:

- Many advisors are working under the assumption that their client base is primarily married Caucasian males in their mid-50s, when in reality only 35% of affluent Americans are 55 or older.

- Although many advisors have clients with young children, they often fail to establish any sort of rapport with their clients’ offspring, thereby hampering their ability to develop a relationship with the next generation should the client parent divorce or die.

What’s more, according to Pershing, it’s critical to both the financial industry and the next generation of investors to increase the percentage of women advisors in the field from the current rate of 30% for a number of reasons:

- Many women investors prefer to work with women advisors.

- Women advisors are oftentimes more in tune with new markets.

- The current number of women advisors is not well matched to the changes in the constituency demographic nor does it accurately reflect the importance of women as consumers in the financial industry.

Sallie Krawcheck, the former head of global wealth management at Merrill Lynch, is also an advocate of diversity in the financial sphere. At a recent forum hosted by the American Bankers Association, Krawcheck cited research showing that firms who strive for different backgrounds and perspectives within senior management realize higher returns and lower volatility. She also noted that successful financial firms understand that women clients are a core part of the business whose investment concerns often differ somewhat from men’s. Women frequently live longer than men, Krawcheck noted, and oftentimes retire with less money than their male counterparts, which leads them to view their investments differently and approach their decisions more deliberately.

Finally, a recent Forbes article noted that these demographic shifts have important ramifications for businesses and entrepreneurs as well. “Women and minorities continue to lag behind their white male counterparts in compensation and representation in both large corporations, in start-ups, and in investment and venture capital funding,” noted author Pilar Stella. “Yet, more reports are demonstrating their increasing presence and success, further indicating that they are a force to be recognized for doing business differently, creating equal or better returns, and for positively impacting social and planetary outcomes.”

Clearly, the times are changing, and with these changes come significant shifts in the makeup of the client base. Competition in today’s marketplace is stiff, but for advisors who remain attuned to the changing face of their clients, there is much to gain.