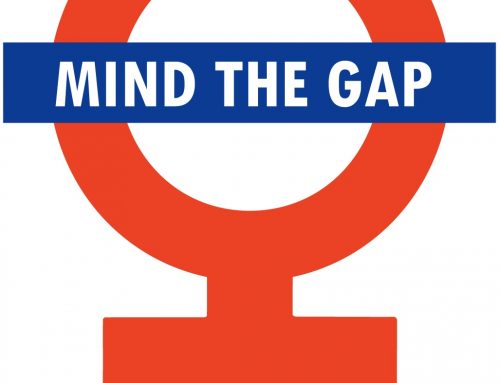

Digital Asset Holdings, a blockchain technology startup led by Blythe Masters, recently announced that Sallie Krawcheck would join their executive board. Resultant headlines trumpeted the collaboration of two powerful Wall Street women. Masters’s startup has attracted $60 million in funding from JP Morgan and Goldman Sachs. Krawcheck is set to launch her digital investment platform, Ellevest, this year. However, dig a little deeper into the world of fintech, and you will find the usual discussions over the gender gap. I wrote about fintech a few months ago and its potential to disrupt the financial services industry through a variety of innovative services and solutions. Could the essence of “disruption” that fintech provides also disrupt entrenched gender bias? Some of the most prominent movers and shakers right now are women.

Blythe Masters, CEO, Digital Asset Holdings

The 25-year veteran of JP Morgan left the firm when they sold the commodities business she headed. In 2015, she launched Digital Asset Holdings to bring blockchain technology to the financial markets. Blockchain is the underlying technology of the internet currency bitcoin. While bitcoin itself is controversial, blockchain itself can be used for other processes and Masters believes it will revolutionize outdated and expensive practices. In the simplest terms, blockchain is essentially a streamlined database technology.

“The blockchain is nothing more than an enhancement on present record-keeping systems, Masters says, estimating that the technology could eliminate billions of dollars worth of redundancy, latency, and error costs in the post-trade processing of assets like bonds and equities.”

Her take on gender issues in the workplace is refreshingly honest: “Gender bias is alive and well. You don’t have to look far online or in the media to see it. For most successful women, overcoming the consequences of this becomes an explicit challenge at some point or other in their careers. This is when the power of a network, and of enlightened male colleagues who work hard to overcome unconscious bias in their organizations is most powerful.”

Catherine Bessant, Chief Operations and Technology Officer, Bank of America

In a world where “likeability” still determines a woman’s success, Catherine Bessant did not let that derail her. In a recent interview about her past demotion at Bank of America, she relayed the story that while she was a respected executive and leader in the community, her fellow employees didn’t “like” her. Yet today, Bessant is leading Bank of America into the world of financial technology. Her focus on simplification for customers and commitment to technology investment at the bank signal a non-traditional tech officer. She doesn’t believe in “innovation labs” because “banks are a low margin business” and innovation must be targeted—not innovating for the sake of it. Yet, she has managed to secure a $3 billion budget for software development, 17% of the overall IT budget. Bessant bridges the gap between banker and technologist and says: “It’s hard to tell if technology is our business or the business of technology.”

Anne Boden, CEO, Starling Bank

Another banking veteran, Anne Boden was most recently COO of Allied Irish Banks before her startup venture, Starling. Aimed at “people who live their lives on their phones,” the digital bank aims to challenge traditional banks. Starling has attracted $70 million in investment as well as a number of industry heavyweights joining its team. Starling’s website promises it will be much more than an “app and a debit card,” mentioning payment, budgeting, and saving. Boden says, “‘I came to the conclusion that banking is broken…it is broken and it needs fixing. And the only way to fix it is to start from scratch.’” Her thoughts on the gender gap in business? “If you are twice as smart as the guys and work twice as hard as them you will get promoted just as quickly.”

We are only seeing the beginning of technology remaking the finance world. It’s time for technological innovation to make its way into banking and financial markets. Is it possible these companies led by women with their honest views of gender issues and innovative ideas also start to push the gender gap closed?