In an article entitled “What Pope Francis can teach CEOs about leadership,” the finance writer Allison Linn raised some compelling observations that should resonate for those working in the financial services industry.

In an article entitled “What Pope Francis can teach CEOs about leadership,” the finance writer Allison Linn raised some compelling observations that should resonate for those working in the financial services industry.

Though there are few obvious parallels between the Catholic Church and financial services, both are global institutions reeling in the wake of crises brought about by acts of individual malfeasance that revealed broader systemic problems. As a result, public confidence in both institutions is low.

A Message of Radical Humility

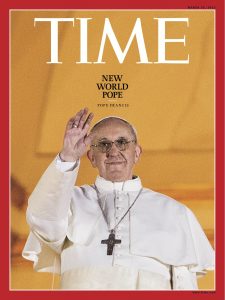

Understanding the need to set a different tone in leadership, Pope Francis was quick to distinguish himself from his recent predecessors when he was named pope last Tuesday.

The New York Times reports:

“In an ancient institution where style often translates into substance, Francis, in his first 24 hours as pope, has dramatically shifted the tone of the papacy. Whereas Benedict XVI, the pope emeritus, was a theologian who favored red loafers, ermine-lined cloaks and erudite homilies, reviving papal fashions from centuries past, Francis, the former Cardinal Jorge Mario Bergoglio of Buenos Aires, appeared Thursday to be sending a message of radical humility.”

Pope Francis’ humble tone is a step towards restoring the public’s confidence in the Church and its leadership. The hope is that the new pontiff can reunite a church that has been haunted by scandal and mismanagement.

Allison Linn writes:

“It’s a smart move for a man who has just picked to lead an organization desperate to regain the public’s trust and reinvigorate its many workers. In fact, it’s something that many American chief executive officers could learn from.”

CEOs heading organizations that have also been plagued by scandal and mismanagement would be smart to follow Pope Francis’ humble path.

Setting the Right Example

The recent scandals that engulfed Wall Street banks and financial institutions, have resulted in the public’s loss of trust in its financial institutions. That broken trust is a hard thing to repair.

Hence, all the uproar when bonuses continue to rise even in the face of a weak and unpredictable economy. It was recently reported by the Associated Press that, “Wall Street cash bonuses for 2012 are expected to rise 8 percent to $20 billion,” despite the loss of about 500,000 finance-sector jobs since 2008.

In their 2012 compensation survey, American Banker reports that even as shares slumped, CEO pay continued to climb approximately 16% per year.

But this tone-deaf approach by some C-Suite executives can cost them their positions. Linn writes:

“Chief executives acting in a time of crisis also can build, or ruin, their reputations depending on the examples they set. Former Citigroup CEO Vikram Pandit drew accolades in 2009 when he agreed to take a salary of just $1 as the nation was grappling with a recession and the results of the financial crisis. But not long after, he was seen as a symbol of overly lavish pay when Citi’s shareholders voted down his $15 million pay package. He stepped down last fall.”

The Humility Imperative

Social Media entrepreneur and CEO Dave Balter found out the hard way that his big ego was damaging his business and limiting his effectiveness as a leader. Today, he preaches the gospel of humility.

Balter writes:

“The humility imperative is simple: If you’re an ego-fueled leader, find humility today, before it’s too late. Disregard the fawning fanboys and king-like power you feel right now. Instead, choose to recognize your place in the universe is no more important than anyone else’s. Know you can learn from every single interaction—no matter the person’s credentials. Understand that your competitors are smart—perhaps (gasp!) even smarter than you. Believe that media glory is fleeting. Here’s what matters more: You treat your employees with kindness; You are willing to be wrong; and—yes, this is hard—you share the spotlight.”

In order to rebuild trust, CEOs need to take a page out of Pope Francis’ book. They need to forgo the pomp and circumstance of corporate jets, lavish pay packages, and endless entitlements. They need to reconnect with their workers, their shareholders, their investors, and the public at large.

Humility can be one of a leader’s greatest strengths and most powerful weapons of change.